2024 Alternative opportunities: Alternatives outlook

Executive summary

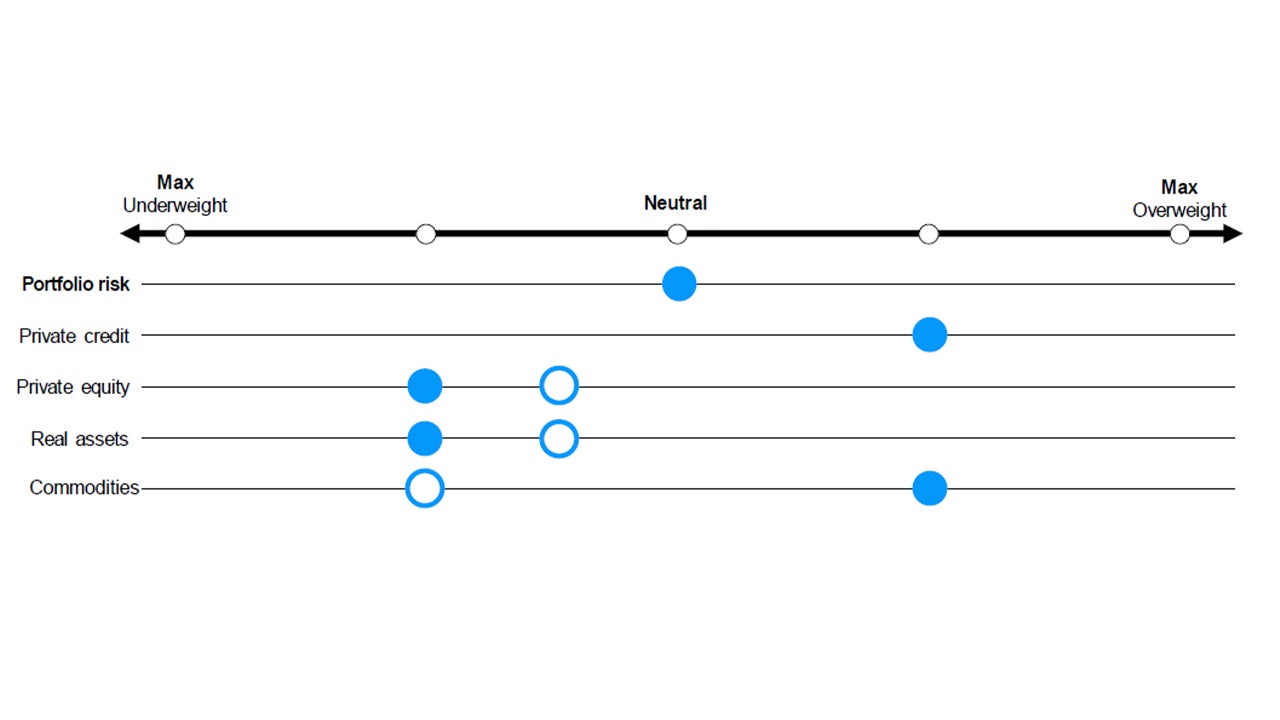

• Private credit: The current environment is extremely conducive to executing conservatively structured transactions. Leverage levels on new transactions across the market have declined, while Loan-to Value (LTV) metrics have meaningfully improved. Given the improved structures, current transactions are being completed with significant equity in a first-loss position. We are anticipating an improved opportunity set with distressed and special situations debt as the $6 trillion market across leveraged credit is quite sizable on an absolute basis. Commercial real estate debt is anticipated to remain highly attractive, especially for those with favorable sources of financing.

• Private equity: We have seen a heightened focus on growth equity strategies, illustrated growth equity representing roughly one out of every five deals during the quarter. Growth equity deal count is on pace to potentially exceed total LBO volume if you exclude add-on transactions. This highlights the continued theme reflecting a more favorable opportunity set for companies that can rely on organic growth to drive return relative to those that require the use of leverage which comes at a high cost in the current environment.

• Real assets: Capital markets are disrupted as yields and cap rates are increasing in reaction to elevated interest rates. While asset values continue to reprice, banks are focused on existing loan books and so offer limited new liquidity, thereby impacting the volume of real estate transactions in all key markets. Within infrastructure, while historical the level of dry powder remains elevated, and valuations, similar to those in real estate, have not backed up with base rates, near term fundamentals are strong and secular tailwinds supportive. Commodity prices remain volatile and rangebound across most sub-complexes and while our secular trend assessment is currently net attractive, we caution it is subject to sudden change.

Source: Invesco Solutions, views as of Sept. 30, 2023